Last Thursday, a bill passed through the Missouri House which will successfully remove local income tax on long-term investments. This new bill has aroused worry and arguments among politicians, but ultimately was initiated to boost economic growth.

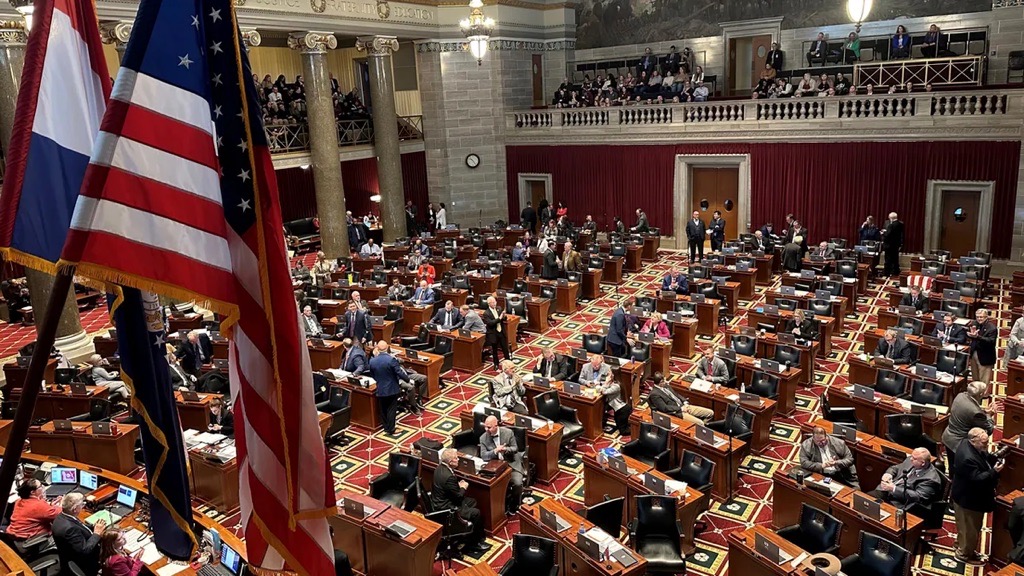

The bill was passed 100-48 within Missouri’s house, and was led by mostly Republicans. Although this original bill concerning investments was triumphant, the bigger question is whether or not income taxes could be completely removed from Missouri by the year 2027.

The idea behind this popular bill is to draw in business. Many states, including Texas and Tennessee have already adopted tax-free policies. Because of this, these states have become superpowers and their economy has nearly doubled. By exempting taxes, the idea is that Missouri too could have an economic boost, especially for local businesses.

Members of the Republican Party support removing all income taxes. They successfully eliminated one category of income tax, so they undoubtedly believe they could continue their logic. Passing the original bill helped support small businesses and those seeking retirement, however many individuals questioned the benefits of completely eliminating taxes.

Republicans claim cutting income taxes would give Missouri citizens an economic revival. However, it comes with a cost. Eliminating income tax would cost the state treasury over $341 million dollars, an amount many individuals believe the government shouldn’t pay. Additionally, as a result of removing income taxes, sales taxes would increase, an idea many politicians despise.

Because of this, many members of the Democratic Party oppose the proposal, and actively work to prevent the bill. They argued that Missouri’s limited taxes would cause the local economy to drop even more. Some even admitted that, it seemed the original bill was passed to appease voters, rather than help the state as a whole.

Additionally, Democrats worry about Missouri’s future. Passing a tax-free bill seems sudden, and could potentially harm Missouri’s economy. Once the bill is in effect, it’s impossible to turn back and that thought stirs the pot for local politicians. This mainly applies to service companies and those that rely on taxes. If Missourians aren’t paying local fees, how are they to make a living?

This debate isn’t set to end any time soon. Although Republicans hold more power in the current House, there’s no doubt the Democrats will fight back. Exempting taxes could make Missouri an economic powerhouse, but many politicians still question whether or not it’s worth the risk.